True or False?

Although there have definitely been monetary policy effects on the nominal exchange rates of the United Kingdom and Japan with respect to the United States and, because of price level inflexibility, these effects may have spilled over onto the corresponding real exchange rates to some extent, there is no evidence of a response of real exchange rates to unanticipated money supply shocks. What effects there were on real exchange rates had to have been moderated by the authorities through adjustments of their policy in order to maintain foreign exchange market stability. And such real exchange rate effects were certainly only temporary because it appears that the public's inflation rate expectations adjusted rather quickly to the policy pressures that were occurring.

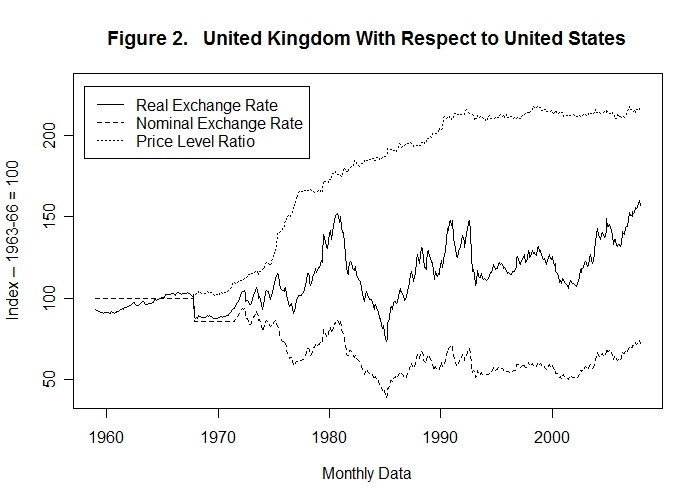

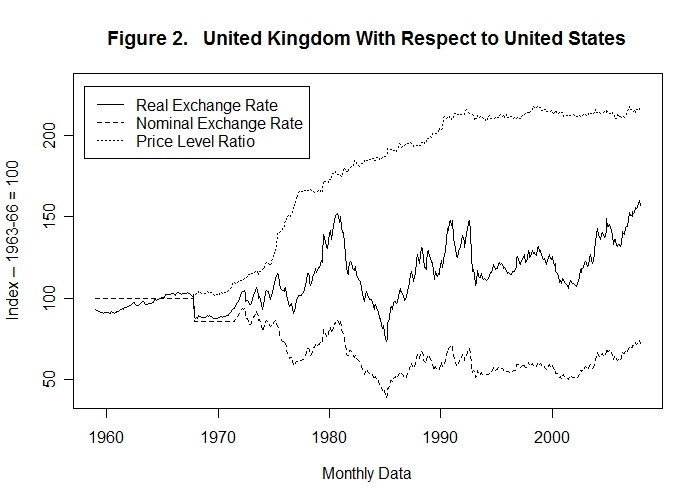

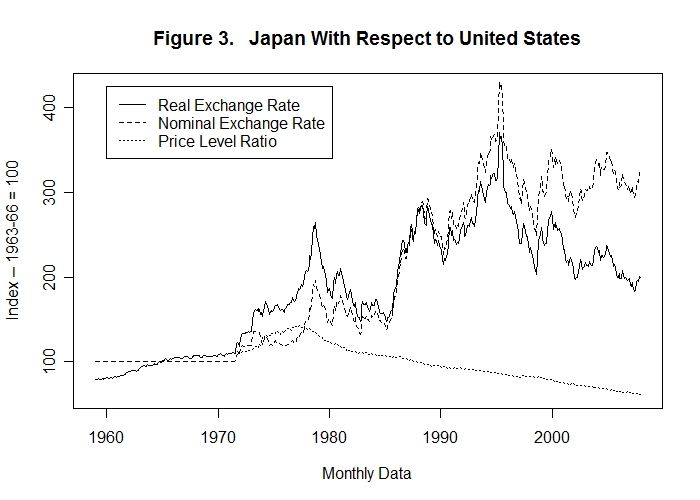

Have another look at Figures 2 and 3 which are reproduced below

There were two observable major declines in the British inflation rate relative to that in the United States---one in the late 1970s and another in the early 1990s. It is possible that some parts of the upward adjustments of the real echange rate that occurred around those times were due to tight monetary policies. Most of the ongoing real exchange rate adjustments, however, occurred over substantial intervals during which the domestic inflation rate was very stable relative to the inflation rate in the United States.

There was one major change in the Japanese inflation rate relative to that in the United States that occurred in the 1970s shortly after the nominal exchange rate was allowed to float freely. Around the time that the inflation rate was undergoing that major downward adjustment the Japanese real exchange rate with respect to the United States increased substantially. But again, the major movements of the real exchange rate before and after those years were surely unrelated to changes in the relative inflation rates, since the Japan/U.S. price level ratio was virtually a straight line.